High Returns, Low Hassle – Welcome to Zylo P2P !

Zylo offers a smarter way to invest your money. By connecting you directly with creditworthy borrowers across India, we empower you to earn potentially higher returns while making a positive impact.

- Flexible Investment Options

- PAN India branch network

- Creditworthy small business borrowers

- High Liquidity & Reinvestment

Your Path to Prosperity Starts Here. Invest in Success..

How P2P Lending Platform Works

Zylo’s P2P investments are regulated by the Reserve Bank of India (RBI). All transactions go through secure escrow accounts, adding an additional security layer.

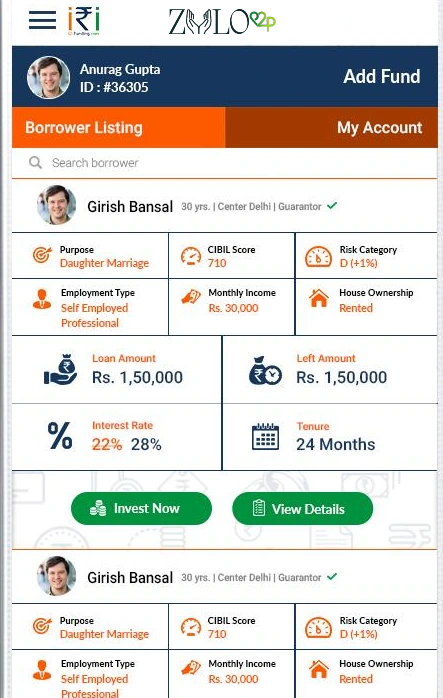

- We evaluate borrowers' creditworthiness.

- Qualified borrowers are assigned a loan grade.

- Borrowers create loan listings.

- Investors place bids on loan listings.

- Successful bids are funded.

- Borrowers repay the loan with interest.

Get in-depth insights on your cashflow

P2P lending can offer significantly higher returns compared to traditional investment options. Enjoy the flexibility of high liquidity along with reinvestment options.

- Investments regulated by RBI

- Flexible Investment Options

- High Liquidity & Reinvestment

Empowering You to Earn Higher Returns

RBI Regulation

Being a regulated entity under the Reserve Bank of India (RBI), adheres to strict guidelines for investor protection.

Escrow Accounts

Investor funds are typically held in escrow accounts, separate from the platform’s operational funds.

Credit Assessment

Rigorous credit evaluation processes to assess borrower creditworthiness, reducing the risk of defaults.

Low Default Risk

Proven low default rate, supported by Zylo’s extensive industry experience and strong repayment culture.

High Yielding Returns

Enjoy average returns, outperforming traditional investment options like stocks, real estate, bonds, and fixed deposits.

Planned Diversification

Spread your risk across multiple loans with investments starting from just ₹1,000. An attractive option for HUFs.

Ramesh Gupta

"The user-friendly platform and transparent processes have made investing easy and profitable."

Amita Patel

"The app is perfect for busy professionals who want to invest on the go."

Meena Sharma

"The educational resources helped me understand P2P lending and diversify my portfolio."